Today's Best Equity Line Plus Rate Options

-

Fixed Rate Segment - For Options 2 & 3

as low as6.79%APR -

Principal & Interest Payment

as low as8.25%APR -

Interest Only

Paymentas low as8.25%APR

Home Equity Qualification Calculator

Use this calculator to determine the home equity line amount you may qualify to receive. The loan amount is based on a percentage of the value of your home.

NOTE: Calculators are for illustrative/research purposes only and do not reflect the actual results of any specific loan amount. Please contact Unitus for an accurate calculation.

Benefits that make borrowing simple

-

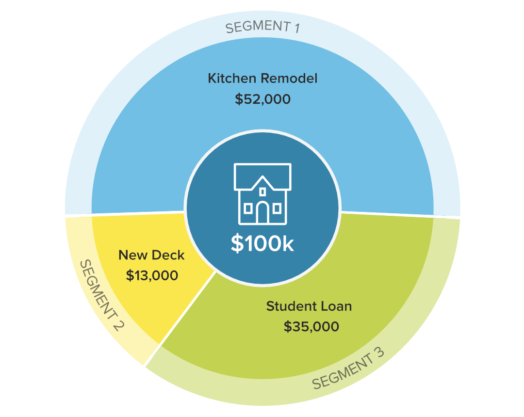

Borrow only what you need

Free up credit as you make payments, so you can re-draw money as you need.

-

Flexible Credit Line Amounts

Line amounts start at $10,000 to meet your needs.

-

No Interest Until You Withdraw

Easy access to cash, but you don’t pay any interest until you actually withdraw it.