Your Home’s Equity Can Make Big Plans Happen.

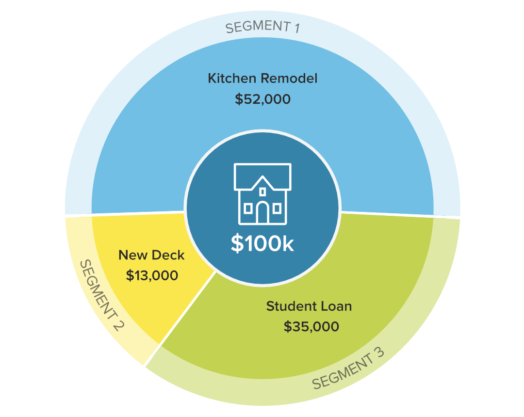

Whether you’re planning a kitchen remodel, consolidating higher-rate debt, or getting ready for life’s next milestone, your home’s equity can help. With our Home Equity Loan or Home Equity Line of Credit (HELOC), you get access to competitive rates, flexible terms, and the support of Unitus Community Credit Union.

Home Equity Fixed Loan

Choose a home equity fixed loan if you need a one-time lump sum to use as you wish.

- Locked in rate for term of loan – Gives you the stability and protection from rising interest rates.

- Predictable payments each month – Makes budgeting simple and stress-free.

- Flexible term options – Helps to keep payments affordable.

- No prepayment penalty – Allows you to pay down your loan faster and save on interest.

Home Equity Line of Credit (HELOC)

Choose a Home Equity Line of Credit if you need a revolving credit line for maximum flexibility.

- Borrow only what you need – Free up credit as you make payments, so you can re-draw money as you need.

- Flexible credit line amounts – Line amounts start at $10,000 to meet your needs.

- No interest until you withdraw – Easy access to cash, but you don’t pay any interest until you actually withdraw it.1

- Generous repayment period – 10-Year draw period with a 20-Year repayment period.

Unsure which home equity option is right for you? Our comparison chart below makes it easy to see how a Home Equity Loan and Home Equity Line of Credit stack up.

Home Equity Loan vs. HELOC

| Home Equity Loan | Home Equity Line of Credit (HELOC) | |

|---|---|---|

| Best for | Large projects and construction | On-going projects and recurring or unexpected expenses |

| Payments | Fixed monthly | Principal and interest or interest-only during draw period |

| Collateral | Primary or secondary home | Primary or secondary home |

| Fixed or Adjusted Interest Rate | Fixed | Adjustable with options available for fixed rate/term |

| How you receive funds | Lump sum | Advance as needed during the draw period |

| Terms | 5-30 Years | 10-Year draw period with a 20-Year repayment period |

| How much you can borrow? | Up to 65% CLTV, 780 FICO, and $100,000 loan amount.2 | Up to 80% of available equity in home2 |

| Annual fees | None | $50 beginning on the first anniversary of account origination; waived if an average monthly balance of at least $10,000 maintained for the entire prior year. |

| Apply for a Home Equity Loan | Apply for a HELOC |

Home Equity Loan

| Best for | Large projects and construction |

|---|---|

| Payments | Fixed monthly |

| Collateral | Primary or secondary home |

| Fixed or Adjusted Interest Rate | Fixed |

| How you receive funds | Lump sum |

| Terms | 5-30 Years |

| How much you can borrow? | Up to 65% CLTV, 780 FICO, and $100,000 loan amount.2 |

| Annual fees | None |

| Apply for a Home Equity Loan |

Home Equity Line of Credit (HELOC)

| Best for | On-going projects and recurring or unexpected expenses |

|---|---|

| Payments | Principal and interest or interest-only during draw period |

| Collateral | Primary or secondary home |

| Fixed or Adjusted Interest Rate | Adjustable with options available for fixed rate/term |

| How you receive funds | Advance as needed during the draw period |

| Terms | 10-Year draw period with a 20-Year repayment period |

| How much you can borrow? | Up to 80% of available equity in home2 |

| Annual fees | $50 beginning on the first anniversary of account origination; waived if an average monthly balance of at least $10,000 maintained for the entire prior year. |

| Apply for a HELOC |

Today's Best Home Equity Loan Rate Options

Select the Home Equity Loan product you'd like to apply for below.

Home Equity Fixed Loan

Home Equity Line of Credit (HELOC)

-

Fixed Rate Segment - For Options 2 & 3

as low as6.79%APR -

Principal & Interest Payment

as low as8.25%APR -

Interest Only

Paymentas low as8.25%APR

Home Equity Qualification Calculator

Use this calculator to determine the home equity line amount you may qualify to receive. The loan amount is based on a percentage of the value of your home.

NOTE: Calculators are for illustrative/research purposes only and do not reflect the actual results of any specific loan amount. Please contact Unitus for an accurate calculation.

Home Equity FAQs

-

Current Assessed/Appraisal Value of home ($450,000) minus Balance of Mortgage ($200,000) = Your Equity ($250,000).

-

Use the funds how you like for purposes like; home renovations and remodeling, hight-rate debt consolidation, create a rainy day fund for emergencies, purchasing another home, or other major life events and expenses.

-

Yes, using the same calculation Current Assessed/Appraisal Value of home minus Balance of Mortgage = Your Equity and product chosen, either a Fixed Home Equity Loan or Home Equity Line of Credit (HELOC) will determine how much you can be eligible to borrow.

-

There are different amounts you can borrow based on our Fixed Home Equity Loan and Home Equity Line of Credit (HELOC) loan programs.

-

You will want to apply before you sign any agreements or contracts with contractors or suppliers for any materials that you will need for your project and allow enough time for your loan to be processed and funded prior to doing so. If you have any specific questions, please ask your Unitus Home Equity Expert.