Support Topics

Checking

Popular Questions

-

Our routing number is 323075699.

-

A POS or “Point of Sale” transaction is a purchase made with your Visa debit card and you are required to enter your PIN on a keypad. POS transactions post to your account immediately. On your statement, a POS transaction will show the amount and the address (and sometimes) the name of the merchant.

-

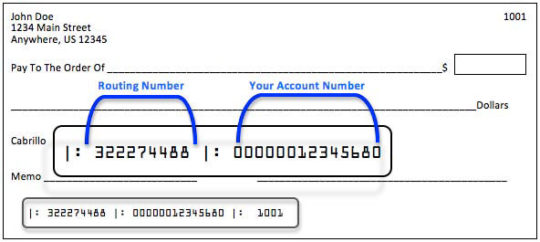

You can find the correctly formatted account number on the bottom of one of your Unitus checks. The first group of numbers on the left is the Unitus routing number. The next group of numbers is your account number.

For direct deposit, you’ll need a 14-digit number. To convert your Unitus checking account number into a correctly formatted 14-digit number, add “1” to the beginning, then add zeros between the “1” and your account number, as needed, to reach 14 digits. Here is an example:

Example account number: 199240616

This account number is 9 digits long, so we’ll add 1 plus four zeros to the front of the number to reach 14 digits: 10000199240616If you have questions, visit a branch or call our contact center at 503-227-5571 or 1-800-452-0900 to obtain the correctly formatted account number for direct deposit.

-

uTransfer is an online tool members can use to transfer money from one institution to another. It is a member-initiated transfer, unlike Online Bill Pay. The member has to set up a withdrawal from another financial institution to deposit into their Unitus account or schedule a withdrawal from their Unitus account to go to another financial institution.

uTransfer is a free service provided to each and every member of Unitus Community Credit Union.

-

Our policy is to make funds from your check deposits available to you on the business day that we receive your deposit. Check holds are placed on a case-by-case basis. If a hold is necessary, funds will generally be available no later than the seventh business day after the day of your deposit. The first $200 of your deposit, however, may be available on the first business day.

Funds from any deposit (cash or checks) made at automated teller machines (ATMs) we do not own or operate may not be available until the fifth business day after the day of your deposit.

-

A POS transaction requires that you key the PIN on a keypad at the cash register. It also posts immediately to your account. A VISA check card charge, or debit charge, either generates a receipt for you to sign, or is a transaction done over the phone or online. VISA check card transactions do not post immediately to the account, but the funds from the transaction are on hold (unavailable) until the charge posts.

-

Unitus offers free overdraft protection transfers from your savings and money market accounts. We also offer overdraft transfers from your Unitus Visa or personal line of credit account, for a small fee, (interest begins to accrue immediately; refer to your loan agreement and disclosure for information regarding loan advances, including repayment terms).

Additionally, we offer an overdraft program on all of our checking accounts (except Right-Choice Checking) called Check Protect. Check Protect is an opt-in courtesy overdraft program that pays checks and debits (except ATM withdrawals) that would overdraw a checking account, up to the account’s Check Protect limit. This is a fee-based service. For additional details please also see our Check Protect Program disclosure.

-

If you suspect fraud on your account, immediately contact Unitus. If the suspected fraud involves your VISA check or credit card, you may block the card at any time by calling 1-800-452-0900 or 503-227-5571 and following the prompts for reporting a lost or stolen card. For follow-up purposes, you can call Unitus during regular business hours to complete the report.

-

To add or remove a joint owner on your account, you will need to complete a Membership Application with the updated information. When adding a joint owner to your account, you will also need to have them sign the application and provide proof of ID. The quickest way to add or remove a joint owner is to submit your request within digital banking (desktop or mobile).

- Desktop: Log in to digital banking banking, click “Tools” at the top of page, and then select the “More Services” to get started.

- Mobile: Launch the Unitus mobile app, click “More” at the bottom of the screen, and then select “More Services” to get started.

Additionally, you can get started by visiting our Virtual Branch. To “drop in” during business hours, log in to digital banking and click the “Let’s talk” button near the bottom of your screen; or schedule an appointment with a branch here.

If you need any other assistance, click that same “Let’s talk” bubble to chat with us online or call our member support team at 503-227-5571 and we’ll be here to help.

-

Instant Issue is a service that allows members to replace a lost, stolen or damaged credit/debit card instantly at any Unitus branch.

-

-

If a member has an Interest Checking account, there is a required minimum balance of $500 to avoid a monthly service fee (unless you’re 50 or older). If the checking balance is below $500 at the end of any business day during the month, a $7.50 service charge will be assessed at the end of the month.

If you are 50 or older, you can sign up for our Optima Club and enjoy the benefits of Optima Checking. Optima Checking is an interest-bearing checking account with no minimum balance.

There is no monthly service fee for Unitus Checking.

-

A stop payment can be placed online by calling 1.800.452.0900 or by logging onto uOnline, selecting ‘Services’, then selecting ‘Stop Draft Placement’. There is a fee for placing a stop payment; the fee can be located here.

-

Deposited funds at Unitus are insured with the National Credit Union Administration (NCUA), a US Government Agency. Regular accounts are insured for up to $250,000; IRA accounts are insured separately for up to $250,000. Please contact Member Services for information regarding multiple account holders.

-

Our Federal Tax ID number is 93-0243503.

-

When transferring to another Unitus account and funds are not available to complete the transfer, no transaction will take place and you’ll receive a notification indicating that you do not have sufficient funds in the source account.

When transferring to another financial institution and funds are not available at the time the external transfer is initiated, no transaction will take place and in the history tab you’ll see an ‘NSF’ (Non-Sufficient Funds) notification rather than the ‘Paid’ notification.

If transferring funds from another financial institution and funds are not available to complete the transfer at the time Unitus attempts to access the funds, the other institution may charge you a fee. Please check with the other financial institution for details.

-

If a check is returned due to non-sufficient funds, a $30 fee is assessed. The processing institution may present the check a second time (depending on their policy). Please note that not all financial institutions present checks twice.

-