When Does a Home Equity Line of Credit Make Sense?

(5 Minute Read) — Local homeowners may be sitting on a pile of cash they can easily access in an emergency, to finance a second home, or to consolidate debt. On average, buying a home in the Portland area will cost you about $549,000 right now; just ten years ago, the average price was $285,500. Quick math shows someone who bought a home in 2014 at the median price could be sitting on $263,500 in home equity.

So, when is the right time to tap into your home’s equity? We turned to the Residential Equity Experts at Unitus to find out. They offered some insight as to who can benefit from a Unitus Equity Line Plus and how this flexible line of credit can help homeowners access the cash they need.

What are some of the benefits of the Unitus Equity Line Plus?

Unitus Residential Equity Experts: The Unitus Equity Line Plus (ELP) is a hybrid loan that combines the flexibility of a line of credit with the peace of mind that comes with a home equity loan with a fixed rate and term. With the Unitus Equity Line Plus you can advance funds as you need them, only paying interest on what you borrow, and being able to advance additional funds as you pay down your principal balance. You also have the option to convert some or all of your loan balance into a fixed rate and term segment, up to five segments are allowed at a time. The minimum payment of the line of credit balance (if any) and the segment(s) minimum payment(s) are combined into one convenient monthly minimum payment.

What are the requirements?

Unitus Residential Equity Experts: The maximum loan amount and repayment period that we may finance varies depending on the value of your home, including any additional liens such as a first mortgage, your credit score, and other requirements. Not every borrower qualifies for the maximum combined loan-to-value (CLTV) or loan amount advertised. Additional restrictions and/or requirements may apply for non-owner-occupied properties, investment properties, second/vacation homes, mobile homes, townhomes, condominiums, and manufactured homes. Contact the Residential Equity Loan Department at 503-423-8380 for details. We do not finance bare land or properties zoned for exclusive commercial or agricultural use.

How does a Unitus Equity Line Plus work?

Unitus Residential Equity Experts: Once your Equity Line Plus application is approved and set up, you can make advances by transferring funds to any of your Unitus accounts or by writing a check from your Equity Line Plus (free checks can be ordered by phone or at any Unitus branch). Any time you have a balance on your ELP line, you can easily convert your balance into a fixed rate/term segment by calling Unitus’ Residential Equity Department at 503-423-8380.

Tell us more about segments.

Unitus Residential Equity Experts: Segments allow you to convert some or all of your Equity Line Plus balance into a fixed rate and term loan within your Equity Line Plus. You can convert balances into as many as five segments at a time, while making one convenient monthly payment combining all line and segment minimum monthly payments. Just as the line portion of the Equity Line Plus, as you pay back the principal on your segments, that amount will become available to reuse during your ten-year draw period.

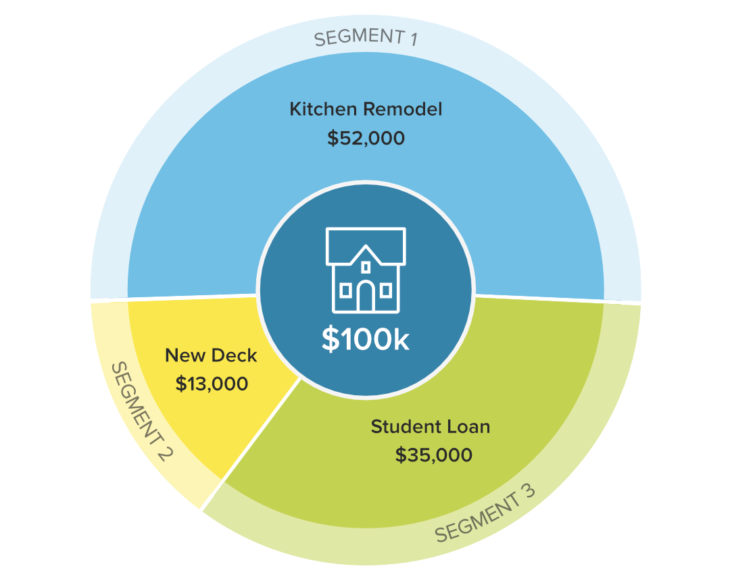

For example, let’s say you have $100,000 available on your line of credit and you want to pay off a student loan totaling $35,000. We’ll set up a fixed-rate segment for $35,000. Later on, when you want to remodel your kitchen for $52,000 and replace your old deck for $13,000, we’ll set up additional segments on your line of credit.

Is this a fixed rate?

Unitus Residential Equity Experts: The Equity Line Plus is a variable rate product which may change monthly based on the US Prime Rate plus a margin. However, an Equity Line Plus balance can be easily converted into a fixed rate and term segment by calling 503-423-8380.

When is an interest only payment beneficial?

Unitus Residential Equity Experts: Choosing an interest only payment may be beneficial depending on your personal circumstances. Some of the most common reasons borrowers opt for an interest only payment include:

- They don’t intend to keep the property very long and/or they are using the Equity Line Plus to pay for repairs or upgrades to the property in order to list the property for sale in a short period.

- The borrower is going to be receiving a guaranteed increase in income or payout (sale of another property, retirement lump sum, inheritance distribution, etc.) that will allow them to make a higher payment or paydown/payoff the balance once received but would like the lower payment in the meantime.

What kind of expenses can a borrower use the funds for?

Unitus Residential Equity Experts: You can use your Equity Line Plus line to pay for whatever expenses that you wish. Most commonly, borrowers use their funds for home improvement, debt consolidation, purchasing large items (other property or vehicles), paying for educational or medical expenses.

If you’re ready to learn more about what a Unitus Equity Line Plus can do for you, contact our team at 503-423-8380, or visit our Home Equity Loan page. We even have a calculator to help you determine the home equity line amount you may qualify to receive. You can view our current rates here.