Spoof Calls: How to Stay Safe from the Hottest Fad in Phone Fraud

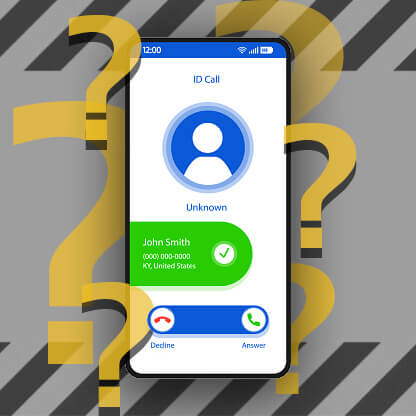

A trend in phone fraud has been gaining steam amongst wrongdoers lately. And this one sports a twist of irony. It’s called spoof calling, sometimes known also as call spoofing or Caller ID spoofing.

What is a spoof call, you wonder? The fraudsters call a credit union member posing as a credit union employee – including a member of the fraud department – in order to persuade them to share sensitive information.

You just can’t make this stuff up anymore!

The scary part: in some cases, the fraudsters can spoof the credit union’s name and phone number in the caller ID to make it appear as if the call legitimately came from Unitus.

What in the world is a thoughtful member to do against forces like this?

Fear not! Keep this one bit of knowledge with you at all times. It will be your forcefield against these scammers and scoundrels.

Unitus will never call you and ask for your card numbers, PINs, online banking credentials, or passcodes. Period.

We may ask you for this information for Identity Verification purposes, but only if you call us. You will never receive a call from Unitus asking you to share any of this information.

If you do receive a call asking for this information, here’s what to do:

- Hang up! Even if it appears to be coming from the credit union. Kindly inform the caller that you will end this call, and call Unitus right back.

- Call us and ask if the fraud department (or whomever the caller said they were) just attempted to contact you. If we didn’t, tell us about that suspicious possible spoof call you just received! The more we know about these, the better we can help protect you and all our other members.

- While you’re on the line, ask us to double-check to see if there has been any suspicious activity on your accounts. It never hurts to check.

To learn more ways to stay safe, peruse this selection of fraud-busting articles: