Comprender su crédito y su puntuación crediticia

What’s on Your Credit Report?

Your credit report is a reflection of your financial reliability. Therefore, it is incredibly important that you understand what information is contained in your credit file.

Your credit report contains the following:

- Personal data, such as name and any names that you have applied for credit with (AKA’s, Maiden Name), social security number, date of birth, and current address, as well as previous addresses and employer information

- Credit accounts, such as credit cards and loans. This information includes credit limits, balances, payment history, and account status (i.e. current, past due, etc.)

- Public record information, such as bankruptcies, collections, liens, and judgments. Bankruptcies will remain on your credit file for up to 10 years; collections, liens and any judgments will report for up to 7 years.

What is a Credit Score?

A credit score represents how well you have managed your credit accounts, with most scores providing a range from 350 (highest risk) to 850 (lowest risk). Most lenders use your credit score to determine whether or not they will grant you a loan and also to calculate how much you will pay in the form of interest. The average credit score in our area is about 690. However, to get the lowest interest rates, your score typically needs to be above 740.

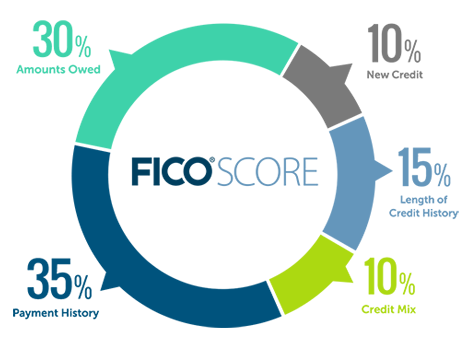

Your credit score is calculated using several variables. However, to make this easy, we’ve consolidated those into five key areas (along with their weighting in your credit score):

- How well you repay your debt (35%) This is the most important factor in your credit file, making up over one third of your total score. Your score is negatively impacted by late payments (anything more than 30 days late), collection accounts, bankruptcies, liens, and judgments. If you’ve made late payments in the past, don’t worry, as time heals all credit-related sins; however, the specific amount of time you must wait depends on the severity of the issue

- How much debt you owe (30%) The second largest factor in your credit report is the amount of revolving debt you owe in relation to your total credit limits. This is a cumulative total of all revolving debt, such as credit cards and lines of credit, divided by the combined total of your credit limits. We recommend you have at least 70% available to you at all times. For example, if you have $5,000 in available credit, you wouldn’t want to carry total balances greater than $1,500. As you can see by this explanation, closing your credit cards can actually hurt your score.

Source: http://www.myfico.com/images/CreditEducation/ce_FICO-Score-chart.png

- The length of time you’ve had credit (15%) Credit scores consider the oldest account on your credit file, as well as the average age of all of your accounts. Quite simply, the older your credit file, the better and the more new accounts you open, the lower your credit score.

- The number of inquiries on your credit report (10%) There are two kinds of inquiries. Credit inquiries are created when you request credit and will stay on your credit report for two years. The more recent the inquiry, the greater the impact to your credit score. Multiple inquiries might suggest financial trouble and that you may be taking on too much debt. Promotional inquiries are requested by lenders who want to provide you with an offer of credit. These companies gain access to limited information on your credit file, such as your name, address and credit score. Promotional inquiries are not seen by others and do not affect your credit score.

- Your mix of credit (10%) The type of credit you have impacts your credit score. It’s best to maintain a mix of revolving lines of credit (i.e. credit cards) and installment loans (i.e. car loans, mortgage loans, etc.)

How to Improve Your Score

Whether your goal is to buy a new house, a car, or a new computer for college, your credit score can be a deciding factor in achieving your goals. If you need to improve your credit score, here are some tips:

- Always pay your bills on time

- Reduce balances on your credit cards and lines of credit, but do not close your accounts

- Carry the majority of your debt in installment loans, such as cars loans, equity loans, and personal loans

- Open and apply for new loans only when absolutely necessary, reducing the number of inquiries and new accounts on your credit file

- Review your credit report regularly and correct any errors that you find.” For more advice, visit our Understanding Your Credit Q&A.

Get a Free Copy of Your Credit Report

By law, you are entitled to a free copy of your credit report once a year. To obtain your free credit report, visit AnnualCreditReport.comllame al 1-877-322-8228 or mail a request to Annual Credit Report Request Service, PO Box 105283, Atlanta, GA 30348-5283. You will be given access to a free credit file from the following three credit bureaus: Experian, Equifax, and TransUnion.

We recommend you visit this website and first obtain your Equifax credit report. Four months down the road, visit this website again and view your Experian credit report. And four months later, check back to view your TransUnion report. This method will allow you access to a free copy of your credit report every four months. If desired, you can also purchase your credit score when visiting this website. And best of all, if you find an error on your credit report, you also will find simple and easy to follow instructions on how to dispute the information.

Opt Out!

Tired of receiving credit card offers in the mail? Did you know that you can opt out of receiving those pre-screened offers of credit? It’s fast and simple. Not only will you reduce your junk mail, but you might also prevent identify theft by reducing the likelihood of someone stealing a credit card offer from your mailbox. Simply call 1-888-567-8688 or visit www.optoutprescreen.com.

An additional tip… If your credit card company routinely sends you blank checks, call them and ask them to stop (they will).

Need More Help?

Come to one of our free Understanding Your Credit seminars. Check the seminars page to see when our next class is scheduled, or call our Member Loan Center. You can speak with any of our trained Member Service Representatives by calling 503-227-5571, option 2.